Nearly ₹12.5 lakhs locked away in a German bank, and you can’t touch it until you land in Frankfurt.

That is the reality of the German blocked account — a mandatory financial proof that most Indian students, job seekers, and Opportunity Card applicants must navigate before stepping foot in Germany.

I remember the anxiety. Watching ₹12+ lakhs leave my Indian bank account, wondering if I’d ever see that money again, praying the visa would come through. The blocked account felt like a leap of faith.

But here’s what I wish someone had told me: it’s not as scary as it sounds. In fact, it’s one of the most straightforward parts of the German visa process — if you know what you’re doing.

3 Ways to Prove Financial Means for a German Visa

Before we dive deep into blocked accounts, know that Germany accepts three main ways to prove you can support yourself:

| Method | Best For | Acceptance Rate |

|---|---|---|

| 1. Blocked Account (Sperrkonto) | Most applicants | ✅ Universally accepted |

| 2. Full Scholarship | DAAD, Erasmus+ recipients | ✅ Accepted if ≥€992/month |

| 3. Verpflichtungserklärung | Those with German sponsors | ⚠️ Accepted but less common |

💱 Currency Note: All INR values in this guide are approximate, calculated at 1 EUR ≈ ₹105. Exchange rates fluctuate daily — always check current rates before transferring.

The blocked account is by far the most reliable option — it’s accepted by every German embassy worldwide with no room for interpretation. Scholarships and sponsor letters can sometimes face additional scrutiny or rejection.

In 2025, over 42,000 Indian students received German student visas (up from 36,000 in 2023), and almost every one of them used a blocked account. Whether you’re pursuing a Master’s in Munich, hunting for a Blue Card job, or exploring the Opportunity Card route — this guide will walk you through everything.

What is a German Blocked Account (Sperrkonto)?

Quick Answer: A German blocked account (Sperrkonto) is a special bank account required by German immigration authorities as proof that you have sufficient funds to support yourself in Germany. You deposit €11,904 (~₹12.5 lakhs) upfront, and after arriving in Germany, you receive €992/month (~₹1.04 lakhs) — ensuring you have steady income for living expenses throughout the year.

📋 German Blocked Account – At a Glance (2026)

Aspect Details Purpose Proof of financial means for German visa Required amount €11,904/year (~₹12.5 lakhs) Monthly withdrawal €992 (~₹1.04 lakhs) after arrival in Germany Who needs it Students, job seekers, Opportunity Card applicants Processing time Account opens in 10 minutes; funds confirmation in 1-3 days Total cost (typical) €12,050–€12,150 (~₹12.65–12.76 lakhs) including fees and buffer

Think of the Sperrkonto as a “financial safety net” that Germany requires. The government wants assurance that you won’t become dependent on public welfare while studying or job hunting. By “blocking” your money and releasing it gradually (€992/month), they ensure you have consistent funds throughout the year.

The word “blocked” sounds scary, but here’s the truth:

- The money is 100% yours

- You get it back — just slowly, month by month

- If your visa is rejected, you get a full refund (minus small fees)

- After 12 months, any unspent money is yours to keep

Who Needs a Blocked Account? Quick Eligibility Overview

| Visa/Permit Type | Blocked Account Required? | Amount Needed | Notes |

|---|---|---|---|

| Student Visa (D-Visa) | ✅ YES | €11,904/year | Most common for Indians |

| Language Course Visa | ✅ YES | €11,904/year | For German language programs |

| Student Applicant Visa | ✅ YES | €11,904/year | For university application process |

| Opportunity Card (Chancenkarte) | ✅ YES | €13,092/year (€1,091/month) | Higher amount required |

| Job Seeker Visa | ✅ YES | €13,092/year | Same as Opportunity Card |

| Au-Pair Visa | ✅ YES | Varies | Check with embassy |

| Training/Apprenticeship Visa | ✅ YES | €13,092 + 10% | Additional buffer required |

| EU Blue Card | ❌ NO | N/A | Employment contract suffices |

| Family Reunion Visa | ❌ NO | N/A | Sponsor’s income proof required |

| Full Scholarship Recipients | ⚠️ MAYBE | Depends | Only if scholarship ≥ €992/month |

Key insight for Indians: If you’re coming through the student route (which 90%+ of Indians do), you definitely need a blocked account. The only exceptions are if you have a full DAAD scholarship or a German resident willing to sign a Verpflichtungserklärung (commitment letter) on your behalf.

The 2026 Numbers: How Much Do You Need?

Current Blocked Account Requirement (2026)

| Category | Monthly Amount | Annual Amount | Approximate INR |

|---|---|---|---|

| Students | €992 | €11,904 | ~₹12.5 lakhs |

| Opportunity Card/Job Seeker | €1,091 | €13,092 | ~₹13.75 lakhs |

| Training/Apprenticeship | €1,091 + 10% | €14,401 | ~₹15.12 lakhs |

Why these specific numbers?

The amount is based on the BAföG rate (Bundesausbildungsförderungsgesetz — the German Federal Training Assistance Act). This is what the German government considers the minimum monthly living expense for a student. The BAföG rate was updated in September 2024, raising the requirement from €934 to €992/month.

Pro tip: The amount increases every 1-2 years. If you’re applying in late 2025 for 2026 intake, check if there’s been an update. The government typically announces changes in August/September.

Blocked Account Providers: The Big Comparison (2026)

There are three major providers trusted by Indian students. Here’s an honest comparison:

🚨 Important: Only use established, EU/German-regulated providers. Some students have lost money to unrecognized “cheap” providers whose certificates get rejected at visa appointments. We’ve added a detailed scam warning section below — please read it before choosing any provider.

Provider Comparison Table

| Feature | Expatrio | Fintiba | Coracle |

|---|---|---|---|

| Setup Fee | €49 | €89 | €99 (⚠️ Currently closed) |

| Monthly Fee | €5 | €4.90 | €0 |

| Total Cost (12 months) | €109 | €147.80 | €99 |

| Buffer Required | €100 | €100 | €0 |

| Account Opening Time | < 24 hours | ~10 minutes | ~2 hours |

| Blocking Confirmation | Instant after deposit | Instant after deposit | 1-2 days |

| Partner Bank | Belgian bank (EU deposit protection) | Sutor Bank, Germany (German deposit protection) | French payment provider |

| Current Account Included | Yes (optional) | Yes (optional) | Yes |

| Health Insurance Bundle | Yes (TK/private) | Yes (DAK/private) | Yes |

| Travel Insurance | Free (92 days) | Free | Free |

| App Available | Yes | Yes | Yes |

| Languages | English, Korean, Chinese | English, Chinese, Spanish | English |

| Trustpilot Rating | 4.7/5 (6,000+ reviews) | 4.6/5 (4,000+ reviews) | 4.5/5 |

⚠️ Important Update (August 2025): Coracle is currently not accepting new blocked account applications as they upgrade their banking system. Check their website for updates.

Our Recommendation for Indian Students

Best Overall: Expatrio

- Lowest total cost (€109 vs €147.80)

- Fast processing

- Free 92-day travel insurance (useful for visa appointment travel)

- ISIC card included (student discounts across Europe)

- Strong support in English

Best for Premium Service: Fintiba

- Only provider with a German bank (Sutor Bank) — full German deposit protection

- Excellent app for managing payouts

- Best for those who want maximum security

- Worth the extra €38.80 if peace of mind matters

Budget Option: If Coracle reopens, it has the lowest long-term cost (€0 monthly fee), but availability is uncertain.

Step-by-Step: How to Open Your Blocked Account

Step 1: Choose Your Provider (Day 1)

Visit Expatrio or Fintiba and start the registration.

Documents needed:

- Valid passport (clear scan of photo page)

- University admission letter (if available — some providers allow opening without it)

- Email address and phone number

Time required: 10-15 minutes

Step 2: Complete Online Registration (Day 1)

Fill in your personal details:

- Full name (exactly as on passport)

- Date of birth

- Nationality

- Current address in India

- Intended start date in Germany

Identity verification: Most providers use video verification. You’ll be connected to an agent who verifies your passport. This takes 5-10 minutes.

Step 3: Receive Your IBAN (Day 1-2)

After verification, you’ll receive:

- Your German IBAN (International Bank Account Number)

- Transfer instructions

- Reference code for the transfer

Important: Keep this information safe. You’ll need the reference code when transferring funds.

Step 4: Transfer Funds from India (Day 2-7)

This is where it gets India-specific. You have several options:

Option A: Bank Wire Transfer (Most Common)

Through your Indian bank (SBI, HDFC, ICICI, Axis, etc.):

- Visit your bank branch with:

- PAN card

- Passport copy

- University admission letter

- Blocked account IBAN details

- Purpose: “Education expenses — German Blocked Account”

- Fill the FEMA/A2 form (for foreign remittance)

- Transfer amount: €11,904 + €100 buffer + provider fees = approximately €12,100 (~₹12.7 lakhs)

Processing time: 3-5 business days Bank charges: ₹500-2,000 + forex markup (typically 1-2%)

Option B: Online Remittance Services (Faster, Often Cheaper)

Popular services for Indians:

| Service | Transfer Fee | Exchange Rate | Speed |

|---|---|---|---|

| Wise (TransferWise) | ~1.33% | Mid-market rate | 1-2 days |

| Instarem | ~1% | Competitive | 1-2 days |

| Remitly | Varies | Varies | 1-3 days |

| HOP Remit | Competitive | Good for students | 1-2 days |

My recommendation: Wise offers the best combination of speed, transparency, and rates. You can see the exact amount in EUR before confirming.

Option C: Provider-Integrated Transfers

Both Expatrio and Fintiba have integrated transfer options:

- Expatrio Payments (with Cohort Go) — Transfer in INR directly

- Fintiba Transfer (with TransferMate) — Multiple currency options

These are convenient but may not always offer the best rates. Compare before choosing.

Step 5: Receive Blocking Confirmation (Day 3-10)

Once your funds arrive, the provider issues a Sperrbestätigung (blocking confirmation certificate).

This document contains:

- Your name

- Account number

- Total blocked amount

- Confirmation that funds are blocked per German regulations

- Provider’s official stamp/signature

This is your golden ticket for the visa appointment. Download it, print multiple copies, and keep digital backups.

Step 6: Use for Visa Application

Include the Sperrbestätigung in your visa application documents. The German Embassy/Consulate will verify the blocked account during processing.

Step 7: Activate After Arrival in Germany

Once you land in Germany:

- Complete Anmeldung (address registration) at the local Bürgeramt

- Open a current account (Girokonto) — many providers offer this as an add-on

- Upload your Anmeldung certificate to your blocked account portal

- Monthly payouts begin — €992 transfers automatically to your Girokonto on the 1st of each month

Real Cost Breakdown: What Indians Actually Pay

Let’s be honest about the total cost. Here’s what you’ll actually spend:

Scenario: Student Opening Expatrio Account

| Item | EUR | INR (approx.) |

|---|---|---|

| Blocked amount | €11,904 | ~₹12,49,920 |

| Setup fee | €49 | ~₹5,145 |

| Buffer deposit | €100 | ~₹10,500 |

| Subtotal to provider | €12,053 | ~₹12,65,565 |

| Bank transfer fee (India) | ~€15 | ~₹1,500 |

| Forex markup (1.5%) | ~€180 | ~₹18,900 |

| Total out of pocket | ~€12,248 | ~₹12,86,000 |

Scenario: Student Opening Fintiba Account

| Item | EUR | INR (approx.) |

|---|---|---|

| Blocked amount | €11,904 | ~₹12,49,920 |

| Setup fee | €89 | ~₹9,345 |

| Buffer deposit | €100 | ~₹10,500 |

| Subtotal to provider | €12,093 | ~₹12,69,765 |

| Bank transfer fee (India) | ~€15 | ~₹1,500 |

| Forex markup (1.5%) | ~€180 | ~₹18,900 |

| Total out of pocket | ~€12,288 | ~₹12,90,000 |

The buffer deposit (€100) covers any unexpected bank fees or exchange rate fluctuations. If unused, it’s refunded with your first monthly payout.

Alternatives to a Blocked Account

Don’t have ~₹12.5 lakhs lying around? Here are legitimate alternatives:

1. Declaration of Commitment (Verpflichtungserklärung)

A German resident (citizen, EU national, or permanent resident) can sponsor you by signing a formal commitment letter.

Requirements for the sponsor:

- Must have sufficient income (typically €2,000+/month net)

- Cannot be receiving certain social benefits

- Must visit the local Ausländerbehörde to sign the document

- Valid for 6 months

Pros: No upfront ~₹12.5 lakhs needed Cons: Finding a willing sponsor is difficult; they’re legally liable for your expenses

2. Full Scholarship (≥€992/month)

If you have a scholarship that covers living expenses, you may not need a blocked account.

Accepted scholarship types:

- DAAD scholarships

- Heinrich Böll Foundation

- Friedrich Ebert Foundation

- Konrad-Adenauer-Stiftung

- Erasmus+ (if it covers full living costs)

Requirement: Scholarship must provide at least €992/month and the award letter must clearly state the amount and duration.

3. Parental Income Proof

Some embassies accept proof of parents’ financial capability.

Documents needed:

- Parents’ bank statements (6 months)

- Salary slips

- ITR (Income Tax Returns)

- Affidavit of financial support

⚠️ Warning: This method is not consistently accepted. Many embassies still require a blocked account even with parental proof. The blocked account is far more reliable for visa approval.

4. Bank Guarantee (Bankbürgschaft)

A German bank guarantees your financial stability instead of holding actual funds.

Reality check: This is rarely used and requires an existing relationship with a German bank — impractical for most Indian applicants.

Our Honest Advice

Just open the blocked account.

Yes, it’s a lot of money. But alternatives are risky — they leave room for interpretation by visa officers, which can lead to rejection. The blocked account is the standard, accepted everywhere, and gives you the highest chance of visa approval.

If you’re worried about funds, remember: this money isn’t gone. You get €992/month after arrival — that’s your rent, groceries, transport, and spending money. It’s forced savings that actually helps you.

Common Mistakes to Avoid

Before Opening the Account

| Mistake | Why It’s a Problem | Solution |

|---|---|---|

| Depositing less than €11,904 | Visa rejection | Always deposit the full amount + buffer |

| Using Kotak Mahindra blocked account | Not recognized by German embassies | Use Expatrio, Fintiba, or authorized providers only |

| Depositing in USD instead of EUR | Amount mismatch | Always transfer in EUR |

| Opening account in someone else’s name | Immediate visa rejection | Account must be in YOUR name (parents can transfer TO your account) |

| Using Deutsche Bank | No longer offers blocked accounts (since July 2022) | Use digital providers |

| Waiting until the last minute | Transfer delays cause missed appointments | Start 4-6 weeks before visa appointment |

During the Transfer

| Mistake | Why It’s a Problem | Solution |

|---|---|---|

| Forgetting the reference code | Funds can’t be matched to your account | Always include the exact reference code |

| Not accounting for exchange rate fluctuations | Arriving amount less than required | Transfer 2-3% extra as buffer |

| Using untrusted forex dealers | Delays, poor rates, potential fraud | Use bank or reputable services (Wise, etc.) |

| Not keeping transfer receipts | Can’t prove source of funds | Save all receipts and SWIFT confirmations |

After Arrival in Germany

| Mistake | Why It’s a Problem | Solution |

|---|---|---|

| Delaying Anmeldung (registration) | Can’t activate blocked account | Register within 2 weeks of arrival |

| Not opening a Girokonto | Nowhere for monthly payouts to go | Open current account immediately |

| Expecting instant access to full amount | Blocked account releases only €992/month | Plan your first month’s expenses separately |

| Forgetting to extend if staying longer | Account closes after 12 months | Apply for extension before expiry |

⚠️ Critical Warning: Don’t Fall for Blocked Account Scams

This section could save you ~₹12.5 lakhs and your Germany dreams.

Every year, we hear stories from the Indian student community about people who lost money to fraudulent or unrecognized blocked account providers. The promise is always the same: “Lower fees! No monthly charges! Faster processing!” But the reality can be devastating — visa rejection, lost funds, and a delayed dream.

Why Scam Providers Exist

Blocked accounts involve large sums (~₹12.5 lakhs). Scammers know that Indian students and families are often looking to save money on fees, and they exploit this. Some tactics include:

- “Cheaper” providers with extremely low or zero fees (if it sounds too good to be true, it probably is)

- Unknown companies with professional-looking websites but no verifiable track record

- Non-EU banking partners whose accounts are NOT accepted by German embassies

- WhatsApp/Telegram groups promoting “agents” who can open accounts at “discounted rates”

- Fake certificates that look official but get rejected at the visa appointment

Red Flags to Watch For

| 🚩 Red Flag | Why It’s Dangerous |

|---|---|

| No BaFin regulation or German banking license | German embassies only accept accounts from regulated providers |

| Banking partner outside the EU | Accounts from non-EU banks are NOT accepted for visa purposes |

| No verifiable office address in Germany/EU | Legitimate providers have registered European offices |

| Extremely low fees (€0-20 setup) | Established providers charge €49-89 for a reason — compliance costs money |

| No Trustpilot/Google reviews | Legitimate providers have thousands of reviews |

| Pressure to pay via crypto or wire transfer to personal accounts | Professional companies have proper payment systems |

| “Guaranteed” visa approval promises | No provider can guarantee visa approval |

| No clear refund policy | Reputable providers always offer refunds if visa is rejected |

Real Consequences Students Have Faced

Based on community reports and embassy warnings:

- Visa rejected at appointment because the blocked account certificate wasn’t from an authorized provider

- Money stuck for months in unregulated escrow accounts with no clear path to recovery

- Kotak Mahindra transfers rejected — Indian bank blocked accounts are NOT accepted by German embassies (the bank must be German/EU-based)

- Fake confirmation letters that the embassy detected as fraudulent

- Total loss of funds when the “provider” disappeared after receiving payment

How to Protect Yourself

✅ Only use established providers:

- Expatrio (Partner bank: Aion Bank, Belgium — EU-regulated)

- Fintiba (Partner bank: Sutor Bank, Germany — BaFin-regulated, German deposit protection)

- Coracle (French payment service provider — EU-regulated)

- German branch banks (Sparkasse, Postbank) if you’re already in Germany

✅ Verify before you transfer:

- Check the provider’s website for banking partner details

- Search for reviews on Trustpilot, Google, Reddit (r/germany, r/Indian_Academia)

- Ask in Brizz community forums — other Indians have been through this

- Contact the German embassy directly if unsure

✅ Never trust agents offering “shortcuts”:

- No legitimate provider uses agents who contact you via WhatsApp

- Always open accounts directly through official websites

- Never share your passport details with unofficial channels

The Math: “Saving” ₹5,000 Can Cost You ₹12+ Lakhs

Let’s be real about the numbers:

| Provider | Setup Fee | Monthly Fee | Total Cost (12 months) |

|---|---|---|---|

| Expatrio | €49 (~₹5,145) | €5/month (~₹525) | ~₹11,445 |

| Fintiba | €89 (~₹9,345) | €4.90/month (~₹515) | ~₹15,525 |

| “Cheap” unverified provider | €20 (~₹2,100) | €0 | ~₹2,100… + potential loss of ~₹12.5 lakhs |

The difference between Expatrio and a scam provider is ~₹9,345 in fees.

Is saving ~₹9,345 worth risking ~₹12.5 lakhs + your visa + one year of your life?

No. It’s not.

What to Do If You’ve Been Scammed

If you’ve already paid a suspicious provider:

- Document everything — screenshots, emails, payment receipts

- Contact your bank immediately — request a chargeback if you paid by credit card

- File a complaint with your local cyber crime cell (India) and the German consumer protection authority (Verbraucherzentrale)

- Report to the German embassy — they track fraudulent providers

- Open a legitimate account immediately — you may still make your visa appointment if you act fast

Our Promise on Brizz.me

We only recommend providers that are:

- Accepted by all German embassies worldwide

- Regulated by German (BaFin) or EU financial authorities

- Protected by the €100,000 EU deposit guarantee

- Have verifiable track records with thousands of Indian students

Your ~₹12.5 lakh journey to Germany is too important to risk for ~₹9,000 in “savings.” Stick with trusted providers.

What Happens After You Arrive in Germany?

Month 1: Activation Process

Week 1:

- Land in Germany

- Find temporary accommodation (hostel, Airbnb, friend’s place)

- Get a German SIM card (for verification)

Week 2: 4. Complete Anmeldung (address registration) at the Bürgeramt 5. Receive your Anmeldebescheinigung (registration certificate) 6. Upload Anmeldung to your blocked account provider’s portal 7. Open a German current account (Girokonto) — N26, DKB, or your blocked account provider’s option

Week 3-4: 8. Blocked account activates 9. First payout (€992) transfers to your Girokonto on the 1st of the following month

Important: Your first month in Germany, you won’t have access to your blocked funds yet. Bring €1,000-1,500 in cash or a travel card to cover initial expenses (deposit, first rent, groceries).

Months 2-12: Regular Payouts

On the 1st of each month, €992 automatically transfers from your blocked account to your Girokonto. You can then:

- Pay rent (typically €300-600 for shared apartments)

- Buy groceries and essentials

- Pay for public transport (semester ticket often included in university fees)

- Health insurance (if not covered separately)

After 12 Months: What Next?

If you’re continuing studies:

- Extend your blocked account (deposit another €11,904), OR

- Show alternative proof of funds (student job income, scholarship, parental support)

If your visa is rejected or you leave Germany:

- Request account closure

- Submit proof (rejection letter/exit confirmation)

- Receive full refund (minus fees) within 2-6 weeks

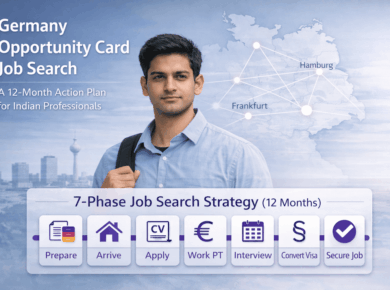

Blocked Account for Opportunity Card Holders

If you’re applying for the Chancenkarte (Opportunity Card) — Germany’s new points-based visa for skilled workers — the requirements are slightly different.

Key Differences

| Aspect | Student Blocked Account | Opportunity Card Blocked Account |

|---|---|---|

| Monthly requirement | €992 | €1,091 |

| Annual requirement | €11,904 | €13,092 |

| INR equivalent | ~₹12.5 lakhs | ~₹13.75 lakhs |

| Purpose | Living expenses during studies | Living expenses during job search |

| Duration | 12 months (extendable) | 12 months (18 months total visa validity) |

How to Open for Opportunity Card

The process is identical to student accounts, but:

- Select “Opportunity Card” or “Job Seeker” category when registering

- Deposit the higher amount (€13,092)

- Mention “Chancenkarte” in the purpose field

Both Expatrio and Fintiba support Opportunity Card blocked accounts.

💰 Sperrkonto Done — What’s Next?

Your blocked account is sorted. Now prepare for life in Germany.

Brizz.me helps you hit the ground running:

- 🏠 Find accommodation before you arrive — Indian roommates, WG rooms, and short-term stays while you settle

- ✅ Book verified services — Transport support, house help, grocery stores, tiffin services, and student consultants who guide new arrivals

- 🎉 Discover welcome events for newcomers — Meet Indians in your city from day one

📍 Don’t arrive alone. Join thousands of Indians on Brizz.me — Your community in Germany.

Frequently Asked Questions

Q12: Can I open blocked accounts with multiple providers?

Technically yes, but there’s no benefit. One blocked account with €11,904 is sufficient. Multiple accounts would mean more fees and complexity.

Transferring Money from India: The Complete Guide

Since this is the trickiest part for Indians, let’s go deeper.

RBI’s Liberalised Remittance Scheme (LRS)

All international transfers from India fall under the LRS framework:

- Limit: $250,000 per financial year per person

- €11,904 (~$12,500) is well within this limit

- Purpose code: S0305 (Studies abroad)

- Tax Collected at Source (TCS): 5% on amounts above ₹7 lakhs (you can claim this back when filing ITR)

Documents for Bank Transfer

| Document | Purpose |

|---|---|

| PAN card | Tax identification |

| Passport (with visa page if available) | Identity verification |

| University admission letter | Proof of purpose |

| Blocked account IBAN details | Transfer destination |

| Form A2 | FEMA declaration for foreign remittance |

| Form 15CA/15CB | Tax compliance (your CA can help) |

Best Time to Transfer

- Avoid month-end: Banks are busier, delays more likely

- Avoid Indian bank holidays: Obvious but often forgotten

- Watch EUR/INR rates: Use apps like Wise or XE to track. Rates can vary by ₹1-2 daily

- Morning transfers: Processed same day; afternoon transfers may queue for next day

If Your Transfer Fails or Delays

- Check reference code: Most common issue — wrong or missing reference

- Contact provider support: They can trace incoming funds

- Get SWIFT confirmation: Your bank provides this; share with provider

- Allow 5-7 business days: Sometimes funds are “in transit” — give it time before panicking

Pro Tips for Indians

Before You Leave India

- Set up international banking:

- Get a Forex card (HDFC ForexPlus, ICICI Travel Card) with €2,000-2,500 for initial expenses like deposits for rental etc

- Enable international transactions on your Indian debit card (backup)

- Download your Indian bank’s app for tracking

- Keep all documents:

- Transfer receipts

- SWIFT confirmation

- Blocking confirmation (Sperrbestätigung)

- Multiple printed copies + digital backups (Google Drive/email)

- Inform your bank:

- Tell them you’re moving abroad

- Update contact number (German SIM later)

- Set up email alerts for transactions

After Arrival in Germany

- Don’t rush expensive purchases:

- Your first €992 comes on the 1st of the month AFTER activation

- Bring cash/forex card for initial expenses

- Avoid big commitments until payout system is running

- Open your Girokonto quickly:

- N26: Fully online, no German address initially required, app-based

- DKB: Best for students (free everything), but slower processing

- Sparkasse/Volksbank: Traditional banks, may require appointment

- Set up automatic deductions:

- Health insurance (Krankenversicherung)

- Semester contribution (if applicable)

- Rent (if landlord prefers)

- This prevents missed payments and builds your financial reputation (Schufa)

Final Thoughts

The German blocked account feels overwhelming at first — ~₹12.5 lakhs is not pocket change. But remember:

This money is not lost. It’s your safety net.

Those €992 monthly payouts will cover your rent, food, and basics. Germany requires this because they want you to succeed, not struggle. A student worried about where their next meal comes from can’t focus on studies.

If you’re reading this and feeling the financial pressure, here’s perspective:

- Many Indian families take education loans that cover blocked account amounts

- The money comes back to you, monthly, for an entire year

- Germany’s nearly-free education saves you lakhs compared to US/UK/Australia

- The investment sets you up for a €50,000+ salary within years of graduation

You’ve got this. Germany rewards those who prepare.

⚠️ Disclaimer: This article provides general information about German blocked accounts based on publicly available sources and personal experience. Immigration rules change frequently. Always verify current requirements with the German Embassy/Consulate in your country, your blocked account provider, and official German government websites (auswaertiges-amt.de, make-it-in-germany.com) before making financial decisions. This is not financial or legal advice.

Last updated: January 2026