If you know me, you know I like to be fun and quirky. But today? No jokes. No fluff. This is serious business—we’re talking money 💶.

Let’s be clear: no bank account = no life in Germany.

- No account, no salary.

- No account, no rent.

- No account, no gym, no internet contract, sometimes not even a mobile SIM.

See the pattern? Without a German bank account, you’re stuck.

But don’t panic—like always, Brizz.me and I got your back. Think of us as your financial GPS, steering you out of the expat maze and into smooth sailing waters. 🌊 Brizz.me is an online platform which will not only help you relocate but also help you find verified rental spaces, local services and events that will make you feel home.

My dear ladies and gentlemen,

here’s the ultimate guide to banking in Germany, where we’ll walk through documents, digital vs. traditional banks, trading options, interest rates, and customer support… so don’t snooze halfway through, grab a coffee and sit tight.

How to Open a Bank Account in Germany: Essential Documents and Requirements

In Germany, life runs on order, rules, and direct debits. Without a local bank account, you’ll keep hitting brick walls.

Want your salary or scholarship? Need to pay rent, bills, or insurance? Planning to sign up for WiFi, a gym, or even online shopping? You’ll need a German IBAN for all of it. And don’t forget—your visa officer and landlord will want proof of financial stability too. So, what paperwork do banks expect? Get ready, because bureaucracy is Germany’s favorite sport. 🏃♂️

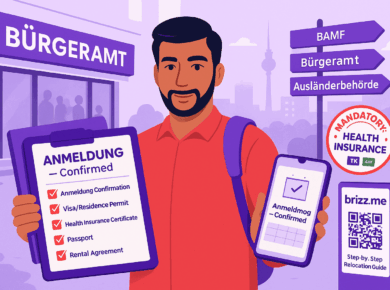

Usually, you’ll need:

- Passport (non-negotiable)

- Anmeldung (address registration) – always for traditional banks, sometimes skipped with digital banks

- Visa or Residence permit (if you’re from outside the EU)

- Proof of income or student ID (depending on the account)

💡 Pro Tip: Just landed and don’t have Anmeldung yet? Start with N26, Revolut, or Wise. These are completely digital platforms that do not need an Anmeldung to open a bank account.

👉 And hey—do your Anmeldung within the first week of landing. Be proactive! Book your Bürgeramt appointment from your home country before flying in. Want to know how? Check out my full Anmeldung guide blog 😉.

The German Banking System in Plain Words

Germany’s banking world has three classic pillars:

- Private commercial banks (Deutsche Bank, Commerzbank)

- Public savings banks (Sparkassen – big in every city)

- Cooperative banks (Volksbank, Raiffeisenbank – member-owned)

And now the modern heroes: digital banks like N26, Revolut, Wise—fast, English-friendly, and zero bureaucracy.

Opening a Bank Account Without Anmeldung Without Anmeldung (N26 vs Revolut vs Traditional Banks)

Here’s the classic German paradox: you need Anmeldung to open a bank account, but you need a bank account to rent an apartment (and get Anmeldung). 😅

Welcome to the German Circle of Doom™ 😉.

But don’t worry, there’s a way out. Digital banks make it possible to open a German account without Anmeldung:

- N26 – All you need is your passport and a German delivery address. No Anmeldung required. It’s fast, modern, English-friendly, and even offers premium plans with up to 4% interest. Perfect if you’re new to Germany. Support is available through in-app chat and email, with full English assistance.

- Revolut – Just your passport is enough. You can start using the app instantly, enjoy multi-currency accounts, real foreign exchange rates, and 24/7 English support. It’s your global travel buddy, ideal for international transfers. Customer service is provided via in-app chat in multiple languages.

- Wise – Best for multi-currency banking. Along with low-cost international transfers, Wise also gives you a German IBAN, making it easier to manage money across borders. Support is offered through an app-based help center with multilingual options, though less personal than N26 or Revolut.

Traditional banks? Forget it—they won’t budge without Anmeldung. That’s why I say: start digital, then switch to traditional once you’re settled.

👉 Smart combo: Start with N26/Revolut → Add a traditional bank later.

Trading & Investment Options in Germany

Banking isn’t just about saving money—it’s also about growing it.

- Volksbank, Commerzbank, and Deutsche Bank offer integrated trading accounts (Depotkonto) where you can buy stocks, ETFs, or bonds.

- Digital trading apps like Trade Republic, Scalable Capital, and ING are also huge here. Easy to use, low fees, and English-friendly.

- Many expats prefer a combo: everyday banking with N26/Revolut, investing with Trade Republic/Volksbank.

👉 Pro Tip: If you’re serious about long-term life in Germany, get a Depotkonto from a German bank. It’s also great for building your financial credibility here.

Bank Interest Rates in Germany

- Traditional savings & daily-access accounts usually offer between 0.01 % and ~1.5 % p.a., depending on bank and balance.

- Some premium/digital banks have launched higher-rate savings “vaults”; for example, N26 offers 2% p.a. (or more for premium plans) for its Instant Savings account under certain conditions.

- Festgeld (fixed-term deposits) rates range from about 2.5 % to ~3.3 % for 1-year terms, with slightly higher rates for longer durations.

Not life-changing, but safe & stable.

German Banking Terms You’ll Hear Daily

- Girokonto – Current account

- EC-Karte / Girocard – Debit card

- Überweisung – Transfer

- Dauerauftrag – Standing order (rent, bills)

- Lastschrift – Direct debit (Netflix, gym)

- Schufa – Credit score

Final Word

Banking in Germany is serious business. Don’t delay it.

Start with N26/Revolut for speed and flexibility. Switch/add a traditional bank for loans, Schufa, and long-term stability. Explore trading banks & apps (Volksbank, Trade Republic) if you want your money to grow. And most importantly: Do Anmeldung within your first week! (check my Anmeldung blog 😉).

When opening a bank account in Germany, choose one with an IBAN starting with DE, as deposits up to €100,000 are protected by the German government. It’s smart to keep a traditional bank account for security and a neobank for everyday flexibility—though most neobanks offer only 3–5 free withdrawals per month. Traditional banks like Deutsche Bank, Postbank, Commerzbank, and HVB share ATM networks, helping you avoid extra withdrawal fees.

Remember: No bank account = No life in Germany. Do it right, do it fast, and the future-you will be very grateful. 😉